Working towards a New Normal: Here is a Snapshot of Recent Conditions

The FEC industry continues to struggle through the COVID-19 pandemic. Unlike most publicly available data based on anecdotal numbers or single-concept public companies, this report gives a view into the industry based on real data from a diverse set of Pinnacle client locations. We will also present an update on the status of Pinnacle’s new and future business, and share opinions of key industry operators, leaders, and groups.

I. Sales Performance vs Prior Year Same Period

Review of Previous Reports: We began tracking store openings and performance vs previous year with the 6-week period ending June 1, 2020. Recall that our analysis tracks arcade sales only. At that time there were only seven “comp” stores, i.e. stores that were open for the full period both years. That steadily improved through the summer and fall. We got to 43 Comp stores in October.

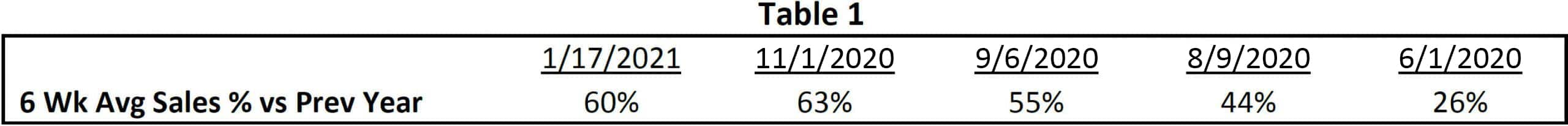

Sales Performance for each of the six-week periods measured was:

The 60% number for WE 1-17-21 requires explanation. The steady build from June through November in sales vs previous year reflected the general public’s growing sense of safety through most of that period. However, starting in early November, Covid cases began to spike in a “second wave’ across the country.

That led to volatility in the industry, generally declining sales and more stores closing, for some or all of the period. Due to the closings we were down to 33 “comp” stores in the 1-17-21 period, shown in Table 2. However, 30% of those stores ran a highly successful promotion for 3 weeks in January, with some irregular accounting. We believe Table 2 overstates performance due to the promotion. We removed the ten stores skewed by the promotion in Table 3. It is that average reported above in Table 1- 60%- for the 6 Weeks ending 1-17-21.

6 Weeks Ending 1-17-20, All Stores:

Table 2 is all 33 Comp Stores (10 stores closed for some or all of the six weeks ending 1-17-21). We believe that the three December weeks are representative of industry averages. The special promotion for 10 of those arcades involved a Pay $30/Get $100 in play. All play was enabled as bonus play and all revenues accounted for elsewhere, skewing the #’s. However it does illustrate that even in tough times a generous offer will generate traffic.

Table 3 adjusts out the “promo stores:” the ten stores that participated in the promotion. This 23-store group declined each of the three weeks in December, hitting as low as 42% of previous year, similar to the numbers we saw back in July. The group then rebounded and grew in each of the three weeks of January. Apparently the customers began to feel safe post-holidays with the group hitting October like numbers in the last two weeks of the period.

Table 4 illustrates the ten arcades under common ownership that participated in the promotion.

II. New Locations

We have now consulted on six location installations since 4-1-2020: One in Colorado in June, one each in New Jersey and West Virginia in August, North Dakota (expansion of existing location) and Oklahoma in December, Ohio in January. Our next will be in March in Oklahoma followed by June in Chicago and July in Wyoming.

We recently signed a location for Q2 2022 in South Dakota and have an Agreement out for signature for Q4 2021.

We have five other projects are on Covid hold, opening dates uncertain.

We are pleased to announce that we have executed a three-year agreement with B&B Theatres to advise management on their entertainment center rollout of multiple locations.

III. “Taking the Pulse”- Our key takeaways from our reading and conversations with industry leaders.

The reduced sales in November and December that we saw in our numbers have been confirmed by operators throughout the country. The good news is that sales have been improving since the New Year and we expect that to continue as the vaccination program increases and the weather warms up.

Theater

Movies: Box Office Magazine online reported the January US box office haul at $55-60 million. This is compared to a $760 million haul in January 2020, or less than 10%. Clearly this is stressing the industry as major markets, specifically California and New York, remained closed and studios do not release content. February is forecast to be worse than January, though some relief is in sight. On March 5 Disney will release its first blockbuster: Raya and the Last Dragon, in both theaters and on Disney+, which will be the first domestic release by that studio since the pandemic started. Many films set to release in March and throughout the Spring and Summer are still on schedule and will provide much needed traffic generations for cinemas. Whether these releases stay on schedule depends on the ability of the country to roll out the vaccine and when New York and California allow theaters to re-open.

The silver lining for the FEC industry in the Cinema industry struggles is that theaters are being pressured to diversify their offerings. Family Entertainment is a natural fit and is significantly outperforming box office during the pandemic in our theater locations. We believe the trend of theaters adding family entertainment will continue and those who do it correctly will benefit greatly. Most theaters still rely on an old arcade business model, designed to get some extra money out of the theater attendees, as opposed to building an attraction.

Cineworld and Cineplex are scheduled to start their civil trial in September 2021 to settle the Cineworld cancellation of their accepted offer to purchase Cineplex. Until the court date both companies are fighting to stay in business given high debt loads and pandemic sales impacts.

Cineplex released their 4th qtr. Results Report. Overall, their sales are down 88% for the 4th qtr, ending the year down 74.9%, with box office revenue down 96%. Player One Amusement Group, a division of Cineplex, was down 70.4% in the 4th qtr. ending the year down 66.3%

AMC has struggled as they have been burning through roughly $125 million a month in cash. Most advisors suggested the company declare bankruptcy in November and AMC began to get the paperwork in order prior to an innovative strategy to sell new shares to smaller investors, which successfully allowed the chain to avoid bankruptcy. There is still a lot of speculation the AMC will ultimately have to file bankruptcy. Regal theaters remain closed and lawsuits from landlords are piling up as they apparently have not been paying rent.

Cineworld Group, owner of Regal, has continued to struggle and their debt is listed by Fitch as some of the most at risk for default.

Well-run independent and smaller chain movie theaters without a heavy debt load are bullish on the theater industry long term. Several are looking for acquisition opportunities as well as management contracts with landlords who find themselves owning theaters due to rent default.

Bowling Entertainment Centers

Since Main Event received an investment of $80 million in June from Redbird Capital Partners, they have been opening new locations. The company appears to be strong and poised for continued growth.

Punchbowl Social declared bankruptcy in December which started a conflict between the company and its lenders. This conflict has been settled and the company is for sale through a bankruptcy auction, expected to close in March.

The winter has been brutal for the bowling industry. This is particularly impactful because Winter is typically the strongest season for profits. The slow winter, including minimal group and corporate business, combined with a likely slow Spring Break this Spring will hurt the industry and may force centers to close permanently.

The two rounds of PPP funding and other government aid have helped operators make it through the pandemic. We believe that revenues in most centers will continue to improve through Spring and anticipate a strong recovery this Summer. While many businesses will be saved, we are hearing that some will not be and third quarter 2021 may see another wave of failed businesses as aid runs out, landlords demand missed rent payments, and loans become due.

Pizza Restaurant with Arcade

California remains closed, so our sales numbers in this category are from the Midwest. The good news in California is that our clients have successfully pivoted to take-out sales from buffet sales which will allow them to make it through the pandemic.

Pizza Arcade sales dipped to about 60% of 2020 through December then returned to 100% of 2020 the week of Jan 10 and 90% the week of Jan 17. These numbers exclude our California locations which are closed, all stores referenced here are in the upper Midwest.

Chuck E Cheese’s has emerged from Chapter 11 bankruptcy with $705 million less debt and $100 million in liquidity.

Trade Shows

Amusement Expo has been rescheduled to June 29-July 1 2021.

F2FEC is scheduled for May 4-6 This will be a scaled down event.

Bowl Expo: Scheduled for June 20-24, 2021 in Louisville, Ky.

The sentiment from exhibitors and attendees is generally positive with wide spread plans to attend in person shows in 2021